Some rebates vary by size and type of measure employed. Under the Net Zero residential construction program, the Maryland Department of Housing and Community Development offers loans for builders, developers and homeowners to construct of rehabilitate residential buildings to energy efficient standards. The credit was amended in 2012 (County Bill 03-12) to add the National Green Building Standard (NGBS) as an eligible green building certification system for the tax credit. For example, a home that consumes 20 kWhs of grid electricity during the night and produces an excess of 20 kWhs of solar electricity during the day would register as having used no grid electricity at all. All efficiency and equipment standards on the Potomac Edison program website and booklet must be met in order to receive rebates. The tax credit generally uses the U.S. Green Building Council's LEED rating system as a metric for determining how "green"' a building is. Electricity suppliers must purchase and retire solar renewable energy credits (SRECs) in order to meet their compliance obligations under the law, or pay a Solar Alternative Compliance Payment (SACP) for any shortfalls in SREC purchases.  This credit pays .85/kWh against the state income tax, for a five-year period, for electricity generated by eligible resources. As if the grant and credits previously explained were not enough, Maryland also compensates you a few tax breaks so you do not have to distress about your tax bills going up because of going solar. Up to $7,500 in rebates are available for implementing needed measures. Baltimore Gas and Electric offers a variety of rebates for electric vehicle supply equipment (EVSE). For additional information, visit the program website or contact Mike Jones at 410-598-2090. about Maryland Rebates and Incentives Summary, Anne Arundel County - High Performance Dwelling Property Tax Credit, about Anne Arundel County - High Performance Dwelling Property Tax Credit, Anne Arundel County - Solar and Geothermal Equipment Property Tax Credits, about Anne Arundel County - Solar and Geothermal Equipment Property Tax Credits, Baltimore County - Property Tax Credit for High Performance Buildings and Homes, about Baltimore County - Property Tax Credit for High Performance Buildings and Homes, Baltimore County - Property Tax Credit for Solar and Geothermal Devices, about Baltimore County - Property Tax Credit for Solar and Geothermal Devices, Baltimore Gas & Electric Company (Gas) - Residential Energy Efficiency Rebate Program, about Baltimore Gas & Electric Company (Gas) - Residential Energy Efficiency Rebate Program. Program is open to farms and businesses in agricultural sector for energy efficiency and renewable energy projects that have total cost of at least $20,000. Montgomery County has exercised this option by offering property tax credits on new or extensively modified multi-family residential and commercial buildings that meet certain high performance building standards.

This credit pays .85/kWh against the state income tax, for a five-year period, for electricity generated by eligible resources. As if the grant and credits previously explained were not enough, Maryland also compensates you a few tax breaks so you do not have to distress about your tax bills going up because of going solar. Up to $7,500 in rebates are available for implementing needed measures. Baltimore Gas and Electric offers a variety of rebates for electric vehicle supply equipment (EVSE). For additional information, visit the program website or contact Mike Jones at 410-598-2090. about Maryland Rebates and Incentives Summary, Anne Arundel County - High Performance Dwelling Property Tax Credit, about Anne Arundel County - High Performance Dwelling Property Tax Credit, Anne Arundel County - Solar and Geothermal Equipment Property Tax Credits, about Anne Arundel County - Solar and Geothermal Equipment Property Tax Credits, Baltimore County - Property Tax Credit for High Performance Buildings and Homes, about Baltimore County - Property Tax Credit for High Performance Buildings and Homes, Baltimore County - Property Tax Credit for Solar and Geothermal Devices, about Baltimore County - Property Tax Credit for Solar and Geothermal Devices, Baltimore Gas & Electric Company (Gas) - Residential Energy Efficiency Rebate Program, about Baltimore Gas & Electric Company (Gas) - Residential Energy Efficiency Rebate Program. Program is open to farms and businesses in agricultural sector for energy efficiency and renewable energy projects that have total cost of at least $20,000. Montgomery County has exercised this option by offering property tax credits on new or extensively modified multi-family residential and commercial buildings that meet certain high performance building standards.

One of the best ways to understand costs and incentivesis to use a tool to help you calculate your solar potential. The credit is formulated as a percentage (%) reduction in. These laws help ensure your Maryland solar installation isnt covered by shade (say, from a neighbors yard) that would limit the production of your system. In other words, this is the amount of energy we deliver to you minus the excess amount you send back to the smart grid. The tax credit is available for, Anne Arundel County offers a one-time credit from county property taxes on residential dwellings that use solar and geothermal energy equipment for heating and cooling, and solar energy equipment for water heating and electricity generation. In November 2010 Baltimore County enacted legislation offering property tax credits for solar and geothermal energy conservation devices installed in residential buildings. This statute allows counties and municipalities to provide a credit against the property tax for buildings which achieve at least a silver rating according to the U.S. Green Building Council's LEED standards, residential structures that achieve a silver rating under the International Code Council's National Green Building Standard (NGBS), or structures which meet other comparable green building ratings or guidelines approved by the State. You may be trying to access this site from a secured browser on the server. One of the earliest policies, adopted in 1985, established Life Cycle Cost Analysis Standards requiring the Department of General Services (DGS) to include an evaluation of the use of renewable energy systems (including active and passive solar and wind systems) and energy efficient strategies (including the effect of insulation and the amount and type of glass and direction of exposure) in creating standards for determining a building's life-cycle costs. Electricity production for on-site use was added in 2006. Photovoltaic (PV) systems and geothermal systems were initially not eligible for the tax credit, but PV systems were added by legislation enacted in January 2009 (County Bill 81-08) and geothermal heating and cooling systems were added in April 2010 (County Bill 17-10). Under this law solar energy devices installed to heat or cool a dwelling, generate electricity to be used in the dwelling, or provide hot water for use in the dwelling were exempt from state -- but not local -- property taxes.

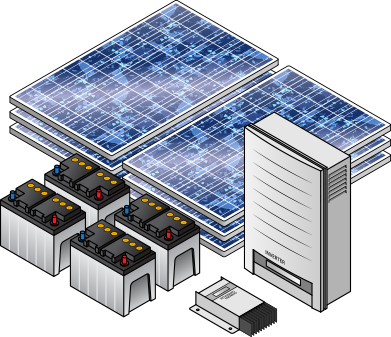

This program allows you to make full use of your own solar energy system, giving you more control over your energy costs. On top of the Maryland solar laws currently in place, there is a great SRECprogram to cash in when youinstall solar in Maryland. As a Maryland taxpayer, you can claim up to 30% of the energy storage system cost as a state income tax credit. In 2007, it passed the EmPOWERing Maryland Act, which required a reduction in the states overall energy use through efficiency and alternative power. If so, you can save even more taxes because of the Federal Investment Tax Credit (ITC). For example, a 37.5 ton system would, Harford County offers a tax credit from real property taxes imposed on residential buildings, nonresidential buildings, or other structures that use solar or geothermal devices for heating, cooling, water heating or generating electricity for on-site consumption. Visit the program website listed above for more information on eligible equipment and program guidelines. MOXIE serves all of Maryland from its location in Owing Mills. In 2012, the state enacted a goal of 2% solar capacity by 2020. Just make sure that your system is less than 20 kilowatts (kW), is in your primary residence, and your installer has the standard NABCEP certification. Harford County - Property Tax Credit for Solar and Geothermal Devices, about Harford County - Property Tax Credit for Solar and Geothermal Devices, Howard County - High Performance and Green Building Property Tax Credit, about Howard County - High Performance and Green Building Property Tax Credit, about Jane E. Lawton Conservation Loan Program, Local Option - Property Tax Credit for High Performance Buildings, about Local Option - Property Tax Credit for High Performance Buildings, Local Option - Property Tax Credit for Renewables and Energy Conservation Devices, about Local Option - Property Tax Credit for Renewables and Energy Conservation Devices, Maryland Clean Energy Program (Local Option), about Maryland Clean Energy Program (Local Option), about Maryland Smart Energy Communities Grant, about Maryland Solar Easements & Rights Laws, Mathias Agricultural Energy Efficiency Grant program, about Mathias Agricultural Energy Efficiency Grant program, Montgomery County - Green Power Purchasing, about Montgomery County - Green Power Purchasing. As required by legislation passed in 2009, DHCD must update the MBPS to incorporate the latest applicable IECC codes within 12 months of publication of the new code editions. For more information, visit the program website. For more detailed information about building energy codes, visit the DOE and BCAP websites. As if the above grants and credits are not enough, Maryland also provides you with some tax relief, so you dont have to worry about increasing taxes and fees because of the use of solar photovoltaic energy. Proceeds may be used for acquisition of a project, construction and development costs, and closing costs. All equipment and installation requirements must be met in order to receive rebates. The MEA anticipates announcing grant winners in March or April of 2017. Maryland has enacted strong interconnection standards which outline how you can connect to the grid. 10451 Mill Run Circle, Suite 499Owing Mills, MD 21117, When you go solar in Maryland you can enjoy the benefits of some clean energy rebates. Rebates are issued on a first-come, first-served basis as long as funding is available. * In Maryland the SACP is set at $400 per MWh for 2009 - 2014, but will decline in, The State Agency Loan Program (SALP) was established in 1991 using funds from the Energy Overcharge Restitution Fund. 377 was enacted, repealing this exemption beginning July 1, 2008. All equipment must meet program efficiency requirements and all necessary documentation must accompany upgrades. If youre planning a larger system, you do not qualify for this grant, but you are then eligible for the state production tax credit (see below).

Rebate applications must include account number, original sales receipt, and must be received within 60 days of purchase. Well work with you to create a complete solar system that is affordable, sustainable and dependable. NOTE: In December 2017, the Maryland Public Service Commission initiated rulemaking docket (RM61) to consider revisions to the small generation interconnection process as recommended by stakeholders of the Public Conference 44 Interconnection Working Group. The list of eligible resources is generally the same as those eligible for. The provisions allowing for micro-CHP systems and certain third-party ownership structures were added in 2009. In order to qualify for the exemption, qualifying pieces of equipment must be designated as meeting or exceeding, Under Maryland law, an SREC represents the generation attributes of 1 megawatt-hour (MWh) of electricity generation (or equivalent) from a qualifying solar facility. All residential customers of Washington Gas in Maryland are eligible to apply for the rebate. Basic requirements for grant funding include: The Maryland Energy Administration (MEA) offers rebates for mid-sized photovoltaic (PV) systems, solar water heating systems (SWH) and Geothermal Heating & Cooling (GHC) installed by businesses, non-profits, and local governments. However, in April 2008 H.B. The program operates as a revolving loan fund where loan repayments from prior awards replenish the fund and allow it to support additional, Similar to Maryland's Local Option Property Tax Credit for Renewable Energy, Title 9 of Maryland's property tax code creates an optional property tax credit for high performance buildings. Solar energy equipment is defined as "equipment that uses solar energy to heat or cool a structure, generate electricity to be used in a structure, or provide hot water for use in a structure". The project must be located in a parking lot in Maryland which is accessible for. Maryland's Residential Clean Energy Grant Program, administered by the Maryland Energy Administration (MEA), provides financial incentives to homeowners that install solar water-heating, solar-electric (PV), geothermal heating and cooling systems, and burning stoves. The provision specifically adding the NGBS (as, Title 9 of Marylands property tax code provides local governments the option to allow a property tax credit for buildings equipped with a solar, geothermal or qualifying energy conservation device. Maryland has a sales tax exemption for your solar panels, racking, inverters, and installation. The state's renewable portfolio standard requires that at least 30.8% of electricity procured. Visit our FAQ page for more information about net metering. Potomac Edison offers rebates for Electric Vehicle (EV) chargers through its EV driven program. The incentive amounts for each technology depends on the capacity of system. Most recently, the Clean Energy Jobs Act of 2019 increased and extended the requirement from 25% by 2020 to 50% by 2030. In 2008, the county also adopted a similar provision creating property tax credits for newly constructed high performance homes, and in 2010 added provisions for energy efficiency improvements in existing homes. The sale of these certificates is completely different from the actual sale or credit from exporting electricity into the grid, which is related to Net Metering (see below). MEA will award up to $750,000 in energy storage tax credits each yearon a first come, first served basis while funding is available. Delmarva Power offers a $300 rebate to residential customers who install a Level 2 smart charger at their home. Marylands net-metering law has been expanded several times since it was originally enacted in 1997. Mathias Agriculture Energy Efficiency program offered by the Maryland Energy Administration (MEA) provides grants to farms and businesses in agricultural sector to offset 50% of the cost of energy efficiency and renewable energy upgrades. renewable energy for heating all county-owned buildings and powering all county-owned vehicles by 2050. Marylands solar easements & rights laws prevent home owner associations (HOA) and zoning authorities from blocking your home solar panel installation. residential customers save energy and money by providing rebates for energy efficient appliances. In April 2007, Maryland enacted legislation (, The Jane E. Lawton Conservation Loan Program takes the place of the former Community Energy Loan Program (CELP) and the Energy Efficiency and Economic Development Loan Program (EEEDLP). The Federal Housing Administration. Please contact our Customer Care Center if you have questions. The current Clean Energy Grant Program provides incentives as follows: Note: As of October 14, 2014, geothermal installations, The Maryland Energy Administration (MEA) provides rebates for the installation of residential and non-residential wind energy systems through the Residential Wind Grant Program and Community Wind Grant Program. Please. By locking in rates for a portion of future power needs and purchasing the balance at real-time rates, favorable trends in power prices are exploited to the State's benefit. The Home Performance with ENERGY STAR Incentive Program also provides residential incentives for envelope and HVAC measures. Single-family detached homes and, The state of Maryland permits local governments (Md Code: Property Tax 9-242) to offer property tax credits for high performance buildings and energy conservation devices (Md Code: Property Tax 9-203) if they choose to do so. Funding for this award is limited. Federal and state incentives are offered to BGE customers who choose to go solar.

How homeowners can purchase renewable energy, Since the energy market in Maryland is deregulated, you can choose your electricity supplier and the source of the electricity you want to buy. Multifamily customers can get a rebate for 50% of the cost of a Level 2 or DC Fast Charging station, up to $20,000. The company also offers a 50% discount for the purchase of Level 2 smart chargers and a 100% discount for the installation of Level 2 smart chargers for multifamily customers, up to $15,000. For more information or assistance with this program, contact Mike Jones at michael.jones1@maryland.gov or visit the program website. Please turn on JavaScript and try again. The most important thing to know is that SREC prices are determined by supply and demand.

The exemption now applies equally to. Through an innovative electricity purchasing strategy for larger accounts, DGS hedges for a portion of the future power requirements of state facilities. PEPCO offers a $300 rebate to residential customers who install a Level 2 smart charger at their home. In place of the rescinded exemption, H.B. Maryland can provide up to $750,000 in tax credits per year, and they grant these credits to eligible participants on a first-come, first-served basis. Tax exemption for the sale and use of renewable energy equipment makes your purchase of a new solar photovoltaic system tax Free. Marylands solar policy has remained popular, with 2014 seeing a 95% increase in the amount of capital invested in solar energy production. Because of the Property Tax Exemption for Solar and Wind Energy Systems, when you use solar energy in Maryland, you do not need to pay any additional taxes on the increased home value. Dont forget the federal solar incentives in Maryland ! There are many opportunities to help you offset the out-of-pocket costs to install a solar generating system. MEA is reserving $300,000 for residential taxpayers and $450,000 for. This statute exempts from the state sales tax all wood or "refuse-derived" fuel used for heating purposes. Solar systems have a significant increase on the value of a home, with one recent study indicating an increase of approximately 3.8% in MD. Maryland offers a production tax credit for electricity generated by wind, solar energy, hydropower, hydrokinetic, municipal solid waste and biomass resources.

In September 2010 the county added a provision limiting total credits to $5,000 per property per fiscal year. * Maryland also provides for the creation of easement agreements for a. The tax credit for solar or geothermal systems is equal to 50%, In May 2007, Maryland established a property tax exemption for residential solar energy systems. The residential program offers a flat per system incentive ($3,000) for systems with up to 10 tons of refrigeration capacity (1 ton is equivalent to 12,000 BTUs). Net Zero homes features may include advanced energy efficient design and technology and renewable energy resources. If you send more energy to the grid than we deliver, you can receive credits on your bill. For more information, visit the program website. The Maryland Energy Administration (MEA) offers the Clean Burning Wood Stove Grant program as part of its Residential Clean Energy Grant Program. As an example, someone who purchases a $30,000 system will receive an extra $7,800 back on their annual tax refund as long as they paid at least that much in federal income taxes over the course of the year. In addition to Marylands generous renewable energy policies, several counties have enacted additional measures to promote the use of solar. Total real property taxes include all real property taxes that would have been paid by the taxpayer for that year for the host building or structure. SRECs can be sold to utilities in Maryland which are required to produce a certain percentage of their electricity from renewable resources, a requirement known as a Renewable Portfolio Standard (RPS) or solar carve-out. This credit pays new solar owners 26% of the total cost of their systems via a personal income tax credit. Delmarva Power offers rebates for electric vehicle supply equipment (EVSE) through the EVsmart program. The law generally applies statewide, including charter counties and Baltimore City. NOTE: Applications for grants for FY2017 program are due by December 15, 2016. There is a wait list for new applicants seeking credits that extends until at least July 2024. Maryland Energy Association incentives will pay additional incentives to ENERGY STAR home building contractors.

Though small, Maryland has emerged as a leader in solar policy. Property Tax Exemption for Solar and Wind Energy Systems, about Property Tax Exemption for Solar and Wind Energy Systems, about Renewable Energy Portfolio Standard. Taxpayers must apply to the Maryland Energy Administration (MEA) to receive a tax credit certificate, which then qualifies them for the tax credit. Montgomery County - High Performance Building Property Tax Credit, about Montgomery County - High Performance Building Property Tax Credit, Montgomery County - Residential Energy Conservation Property Tax Credit, about Montgomery County - Residential Energy Conservation Property Tax Credit, Montgomery County- Expedited Permitting for Solar PV, about Montgomery County- Expedited Permitting for Solar PV, Parking Lot Solar PV with EV Charger Grant Program, about Parking Lot Solar PV with EV Charger Grant Program, PEPCO - Home Performance with ENERGY STAR Incentive Program, about PEPCO - Home Performance with ENERGY STAR Incentive Program, PEPCO - Residential Energy Efficiency Rebate Program, about PEPCO - Residential Energy Efficiency Rebate Program, Permits and Variances for Solar Panels, Calculation of Impervious Cover, about Permits and Variances for Solar Panels, Calculation of Impervious Cover, Prince George's County - Solar and Geothermal Residential Property Tax Credit, about Prince George's County - Solar and Geothermal Residential Property Tax Credit. Using the Federal Investment Tax Credit (ITC), you can claim up to 26% of the cost of solar photovoltaic as a federal tax credit. The system must install a minimum of 75 kW of solar mounted on a canopy structure over the parking lot with a minimum of four qualified Level II or Level III EV chargers. Marylands net-metering rules let you connect your solar panel system to the grid, and if you generate more kWh than you use, your electric company is required to credit you the going rate toward future bills. Because they are bought and sold on an open market, several factors influence their price. Marylands Renewable Energy Property Tax Exemption ensures that new solar energy systems are exempt from property tax assessment value in perpetuity. Maryland's policy for energy efficiency in state buildings is governed by a series of related policies adopted at different times. The library zone below is used to load resources. All equipment and installation requirements must be met in order to receive rebates. Most recently, the Clean Energy Jobs Act of 2019 increased and extended the requirement from 25% by 2020 to 50% by 2030. solar, wind, biomass, anaerobic decomposition, geothermal, ocean, fuel cells powered through, about Residential Clean Energy Rebate Program, about Residential/Community Wind Grant Program, Sales and Use Tax Exemption for Renewable Energy Equipment, about Sales and Use Tax Exemption for Renewable Energy Equipment, Sales and Use Tax Exemption for Residential Solar and Wind Electricity Sales, about Sales and Use Tax Exemption for Residential Solar and Wind Electricity Sales, Sales Tax Holiday for Energy-Efficient Appliances, about Sales Tax Holiday for Energy-Efficient Appliances, SMECO - Residential Energy Efficiency Rebate Program, about SMECO - Residential Energy Efficiency Rebate Program, Southern Maryland Electric Cooperative's (SMECO) Residential Energy Efficiency Program. Baltimore County exercised this option in 2006 by creating property tax credits for new and existing multi-family residential (50+ units) and commercial buildings that meet certain high performance building standards. Note: The eligible technologies listed above are only examples of some improvements that might be supported under this program. The Home Performance with ENERGY STAR Incentive Program also provides residential incentives for envelope and HVAC measures. When the amount of electricity you generate exceeds, the amount used, you can bank it with the utility, and then use it when the amount of electricity you need exceeds the amount of electricity generated by the panel. Note: The eligible technologies listed above are only examples of some improvements that might be supported under this program as detailed on the program web site. The SACP operates as a theoretical ceiling on the price that a supplier would pay for SRECs to fulfill obligations under the Maryland RPS. Maryland had established a renewable energy portfolio standard goal that 2.5% of its electricity will come from solar resources by 2020. The latest version of the Maryland Building Performance. See the program website listed above to view further information on this offering. Their repayments are made from the agency's fuel and utility budget, based on the avoided energy costs of the project. Prince George's County also later extended property tax credit to include leases and solar power purchase agreements. Geothermal equipment is defined as "equipment that uses ground loop technology to heat and cool a structure". Pepco (Potomac Power Company) provides Marylands top utility network metering program. Communities that apply for the program and meet the requirements receive funding based on population size and funding availability. The loans can be used to finance a wide range of energymeasures includinginsulation, windows, HVAC systems, lighting, and distributed generation systems such as solar PV systems and combined heat and power systems. It has two areas of interest: Fleet Alternative Fuel Vehicles and Publicly Available Alternative Fuel Infrastructure. Other improvements may be eligible and not all potentially eligible improvements will be appropriate for all participants. Visit our FAQ page for more information about net metering. Rebates are available for qualifying water heaters and furnaces. The original law prohibited restrictive land use covenants that imposed unreasonable limitations on the installation of solar collection panels on the roof or exterior walls of improvements and which became effective after July 1, 1980. The renewable portfolio standard is divided into two tiers based on the electricity generation resource.

As a bonus, the $1,000 grant is completely tax exempt, meaning it doesnt count towards the income of the recipient. The law permits outright ownership by the customer-generators as well as third-party ownership structures (e.g., leases and power purchase agreements).

Participants must work with a program-approved weatherization contractor to install energy efficiency improvements and weatherization. Use self-generated solar energy to charge the batter? Clean Energy Production Tax Credit (Corporate), about Clean Energy Production Tax Credit (Corporate), Clean Energy Production Tax Credit (Personal), about Clean Energy Production Tax Credit (Personal), about Clean Fuels Incentive Program (CFIP), about Clean-Burning Wood Stove Grant Program, A property may not receive more than one grant per technology per fiscal year, about Commercial Clean Energy Rebate Program, Delmarva Power - Home Performance with ENERGY STAR Incentive Program, about Delmarva Power - Home Performance with ENERGY STAR Incentive Program, Delmarva Power - Residential Energy Efficiency Rebate Program, about Delmarva Power - Residential Energy Efficiency Rebate Program, about DHCD Net Zero Construction Loan Program, Electric Vehicle Supply Equipment (EVSE) Rebate Program, about Electric Vehicle Supply Equipment (EVSE) Rebate Program, about Energy Conservation in State Buildings, on a first come, first served basis while funding is available. Baltimore Gas & Electric Company - Residential Energy Efficiency Rebate Program, about Baltimore Gas & Electric Company - Residential Energy Efficiency Rebate Program, Baltimore Gas and Electric - EVsmart Program, about Baltimore Gas and Electric - EVsmart Program, about Bio-Heating Oil Tax Credit (Personal), about City of Baltimore- BEI Loan Program, The loans can be used to finance a wide range of energy. SREC prices fluctuate in value. The single most important incentive available to anyone considering purchasing a solar system is the Federal Renewable Energy Tax Credit. The City has partnered with two non-profit organizations- Healthly Neighborhoods and Reinvestment Fund- to administer the loans. 517 of 2021 allows "resiliency projects" to qualify for local PACE programs.