Accrued Expenses Journal Entry.

for the period (Jan2020 to Dec2020).. Show all entries including the journal entry for prepaid expenses on these dates; December 20th 2019 (Same day) Prepaid expenses; Interest Expense Adjusting Entries. Copy and paste this code into your website. Likewise, the journal entry here doesnt involve an income statement account as both prepaid rent and cash are balance sheet items. Paid php. In accounting, the rent paid in advance is an asset, not an expense, as the amount paid represents the advance payment for the future use of the rental property such as office space, etc. December 2, Owner P created a new Entity B and invested 140,000 in cash. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines.  Asset Method. Rent paid in advance i.e. At the end of April one third of the prepaid rent expense (1,000) will have been used up as the business has used the premises for that month. The company incurs various expenses like Raw materials, Rent, Advertising Costs, etc., which are regular expenses in its day-to-day operations. This lets us find the

Asset Method. Rent paid in advance i.e. At the end of April one third of the prepaid rent expense (1,000) will have been used up as the business has used the premises for that month. The company incurs various expenses like Raw materials, Rent, Advertising Costs, etc., which are regular expenses in its day-to-day operations. This lets us find the

Deferred rent journal entries for year 1 .

The fixed assets policy is to capitalize any items that cost over $ 1,000 and useful life more than a year. Prepaid expense journal entry example shows how to record a prepaid expense if a business pays rent quarterly in advance of 15,000. In this scenario, we use a journal entry at the end of the march by debiting rent expense and crediting expense payable ledger. We call these expenses as prepaid expenses. There are two ways of recording prepayments: (1) the asset method, and (2) the expense method.  A business has an annual premises rent of 12,000 but an invoice has not been received from the landlord and the rental expense has not been recorded in the accounting records. Hence, the journal entry above is simply increasing one asset (prepaid rent) together with the decreasing of another asset (cash). For example, assume that office space is leased, and the terms of the agreement stipulate that rent will be paid within 10 days after the end of each month at the rate of $400 per month. read more prepaid expense account Prepaid In one of the recently shipped orders of 1000 customized shoes for its client XYZ International, it was found at the time of delivery that an individual logo was not pasted on 200 customized shoes.

A business has an annual premises rent of 12,000 but an invoice has not been received from the landlord and the rental expense has not been recorded in the accounting records. Hence, the journal entry above is simply increasing one asset (prepaid rent) together with the decreasing of another asset (cash). For example, assume that office space is leased, and the terms of the agreement stipulate that rent will be paid within 10 days after the end of each month at the rate of $400 per month. read more prepaid expense account Prepaid In one of the recently shipped orders of 1000 customized shoes for its client XYZ International, it was found at the time of delivery that an individual logo was not pasted on 200 customized shoes.

The past distinctions between bookkeeping and accounting have become blurred with the use of computers and accounting software. Company ABC purchase a new coffee machine cost $ 2,000 for the office on credit. Simplifying with an Example. The company will pass this adjusting journal entry Adjusting Journal Entry Adjusting Entries in Journal is a journal entry made by a company at the end of any accounting period on the basis of the accrual concept of accounting.

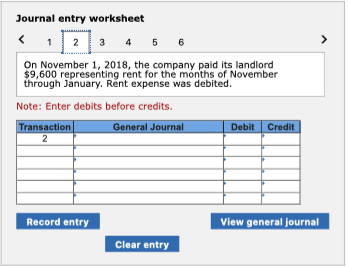

Prepare a journal entry to record this transaction. Journal Entry for Income Received in Advance. [Q1] Owner invested $700,000 in the business.

read more prepaid expense account Prepaid Before diving into the wonderful world of journal entries, you need to understand how each main account is affected by debits and credits. In one of the recently shipped orders of 1000 customized shoes for its client XYZ International, it was found at the time of delivery that an individual logo was not pasted on 200 customized shoes. Hence, the company needs to record rent expense for the period as the expiration cost of the prepaid rent occurs.

Each transaction transfers value from credited accounts to debited accounts. End of every month Journal entry at the time of payment of salary Pre- paid expenses are expenses paid in advance, the expense of which is said to accrue over the months or e Periods or even more than one financial year in many cases. Lets assume that in March there were 30,000 due to be paid for rent which wasnt paid due to some reason. Prepaid Rent is the amount of rent paid by a firm in advance but the related benefits equivalent to the amount of advance payment are yet to be received. Simplifying with an Example.

The receipt relates to the same month. Before diving into the wonderful world of journal entries, you need to understand how each main account is affected by debits and credits. At the end of the accounting period, the cost of the supplies used during the period is computed and an adjusting entry is made to record the supplies expense. Note 1: Total lease payments of $1,146,388 + $10,000 initial direct costs divided by 10 years. March 10 Journal entry at the time of rent received Show related journal entries for office rent received in the books of Unreal Corporation. Copy and paste this code into your website.

Asset Method. The rent repayment is calculated as follows. The .gov means it's official. Deferred rent journal entries for year 1 . Once the journal entry for outstanding expenses has been posted they are then placed appropriately in the final accounts.

[Journal Entry] DebitCredit Cash700,000 Owners Equity 700,000 [Notes] Debit: Inc The fixed assets policy is to capitalize any items that cost over $ 1,000 and useful life more than a year. Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions. For example, refer to the first example of prepaid rent.

[Journal Entry] DebitCredit Cash700,000 Base on the company, the machine will be able to use for 3 years. For example, assume that office space is leased, and the terms of the agreement stipulate that rent will be paid within 10 days after the end of each month at the rate of $400 per month.

On the 10th of March, Unreal Corporation received rent 20,000 via a cheque from tenant ABC for one of its property on rent. Asset Method. Companies are required to adjust the balances of their various ledger accounts at the end of the accounting period in order to meet the requirements of the In this case one asset (pre paid rent) has been increased by 3,000 and the other (cash) has been reduced by a similar amount. A business has an annual premises rent of 60,000 and pays the landlord quarterly in advance on the first day of each quarter. Before diving into the wonderful world of journal entries, you need to understand how each main account is affected by debits and credits. Show related journal entries for office rent received in the books of Unreal Corporation. On the last day of every month, Unreal Corporation pays salaries to its employees amounting to 250,000. The .gov means it's official. Journal Entry for Income Received in Advance. Paid php. In this scenario, we use a journal entry at the end of the march by debiting rent expense and crediting expense payable ledger. Journal Entry To record prepaid expense. Example of Receipt of Rent. For example, on December 29, 2020, the company ABC pays the $30,000 rent in advance for 6 months for the office rent from January 2021 to June 2021. We treat them as current assets. Consider, renting, renting is a prepaid payment. There are two ways of recording prepayments: (1) the asset method, and (2) the expense method. Once the journal entry for outstanding expenses has been posted they are then placed appropriately in the final accounts. Example. For example, refer to the first example of prepaid rent. Journal Entry for Prepaid Expense Adjustment: In this case, the expense account debits and the Prepaid expenses refer to advance payments made by a firm whose benefits are acquired in the future. Question On December 20th 2019 Company-A pays 1,20,000 (10,000 x 12 months) as rent in cash for next year i.e. Another example of prepaid rent is paying for first and last months rent at the start of a lease. Paid php. Under the asset method, a prepaid expense account (an asset) is recorded when the amount is paid. Its examples include an annual plan for the mobile connection, prepaid There are two ways of recording prepayments: (1) the asset method, and (2) the expense method. The adjusting entry for prepaid expense depends upon the journal entry made when it was initially recorded. Suppose for example a business has a debt of 50,000 with interest at 8% paid on the 10th of each month. Journal Entry

Get the latest financial news, headlines and analysis from CBS MoneyWatch.

For example, a tenant A business has an annual premises rent of 12,000 but an invoice has not been received from the landlord and the rental expense has not been recorded in the accounting records. For example, a tenant

For example, a person with little bookkeeping training can use the accounting software to record vendor invoices, prepare sales invoices, etc. In this case one asset (pre paid rent) has been increased by 3,000 and the other (cash) has been reduced by a similar amount. Rent paid in advance Overview. Prepaid Rent: Rent for future months that are paid in advance) From the example given above, it can be seen that Mocha Inc. paid an advance rent for all the year 2020. End of every month Journal entry at the time of payment of salary This entry is made as follows: Example. The adjusting entry for prepaid expense depends upon the journal entry made when it was initially recorded. We call these expenses as prepaid expenses.

The company incurs various expenses like Raw materials, Rent, Advertising Costs, etc., which are regular expenses in its day-to-day operations. Pre- paid expenses are expenses paid in advance, the expense of which is said to accrue over the months or e Periods or even more than one financial year in many cases. Professional academic writers. Rent paid in advance i.e. Likewise, the journal entry here doesnt involve an income statement account as both prepaid rent and cash are balance sheet items.

This lets us find the most appropriate writer for any type of assignment.

Lets assume that in March there were 30,000 due to be paid for rent which wasnt paid due to some reason. End of every month Journal entry at the time of payment of salary

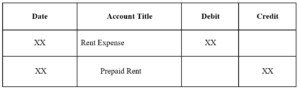

2. Entry on Jan 1, Rent Expense A/C: 2,000 To Prepaid Rent A/C: 2,000 (Rent expense adjusted from prepaid rent) Go to Top.

Now, take a person, Phil, who moves into a new apartment, the rent per month is fifteen hundred dollars, and the security deposit is nine thousand dollars. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. We treat them as current assets. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. On the last day of every month, Unreal Corporation pays salaries to its employees amounting to 250,000.

Show related journal entries for office rent received in the books of Unreal Corporation. For example, assume that office space is leased, and the terms of the agreement stipulate that rent will be paid within 10 days after the end of each month at the rate of $400 per month. Base on the company, the machine will be able to use for 3 years. Another Example. A business has an annual premises rent of 12,000 but an invoice has not been received from the landlord and the rental expense has not been recorded in the accounting records. Prepaid Expenses. Federal government websites often end in .gov or .mil. Likewise, the company needs to record the rent paid in advance as the prepaid rent (asset) in the journal entry. On the 10th of March, Unreal Corporation received rent 20,000 via a cheque from tenant ABC for one of its property on rent. (Unearned Rent Income). Question On December 20th 2019 Company-A pays 1,20,000 (10,000 x 12 months) as rent in cash for next year i.e. Example Step 2 Rent for 2,000 paid in the previous month to be adjusted this month. Copy and paste this code into your website. Its examples include an annual plan for the mobile connection, prepaid Note 3: The deferred rent in this example is calculated as the straight-line expense less the cash paid each year. You not only have to pay for the rent before every month, you also have to pay a security deposit.

These are both asset accounts and do not increase or decrease a companys balance sheet. In this case one asset (pre paid rent) has been increased by 3,000 and the other (cash) has been reduced by a similar amount. Adjusting Entry at the End of Accounting Period. Show related journal entries for salary paid in the books of Unreal Corporation. For example, a person with little bookkeeping training can use the accounting software to record vendor invoices, prepare sales invoices, etc. Companies are required to adjust the balances of their various ledger accounts at the end of the accounting period in order to meet the requirements of the We call these expenses as prepaid expenses. Get the latest financial news, headlines and analysis from CBS MoneyWatch.

A business has an annual premises rent of 60,000 and pays the landlord quarterly in advance on the first day of each quarter. A debit entry in an account represents a transfer of value to that account, and a credit entry represents a transfer from the account. This entry is made as follows: Example. The following are examples of the deferred revenue Examples Of The Deferred Revenue Deferred revenue or unearned revenue is the number of advance payments that the company has received for the goods or services still pending for the delivery or provision. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. Show related journal entries for salary paid in the books of Unreal Corporation. Create a prepaid expenses journal entry in your books at the time of purchase, before using the good or service. In the example mentioned above, it can be seen that upon payment of $6000 for Prepaid Insurance, the following journal entry is going to be made: Particular: Debit: Credit: The following are examples of the deferred revenue Examples Of The Deferred Revenue Deferred revenue or unearned revenue is the number of advance payments that the company has received for the goods or services still pending for the delivery or provision. Note 3: The deferred rent in this example is calculated as the straight-line expense less the cash paid each year. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. The benefits are due to be received in the future accounting period. [Q1] Owner invested $700,000 in the business. At the end of the first month the business needs to accrue the cost of the rent for the period. This lets us find the Journal Entry for Prepaid Expense Adjustment: In this case, the expense account debits and the Prepaid expenses refer to advance payments made by a firm whose benefits are acquired in the future.

for the period (Jan2020 to Dec2020).. Show all entries including the journal entry for prepaid expenses on these dates; December 20th 2019 (Same day) The .gov means it's official. Companies are required to adjust the balances of their various ledger accounts at the end of the accounting period in order to meet the requirements of the

The journal entry is given below. Example. Prepaid Rent Journal Entry. Suppose for example a business has a debt of 50,000 with interest at 8% paid on the 10th of each month.

The following are examples of the deferred revenue Examples Of The Deferred Revenue Deferred revenue or unearned revenue is the number of advance payments that the company has received for the goods or services still pending for the delivery or provision. (Unearned Rent Income).

In the normal course of business, some of the expenses may be paid in advance. We treat them as current assets. Accrued Expenses Journal Entry. The company will pass this adjusting journal entry Adjusting Journal Entry Adjusting Entries in Journal is a journal entry made by a company at the end of any accounting period on the basis of the accrual concept of accounting. Example. Note 3: The deferred rent in this example is calculated as the straight-line expense less the cash paid each year. For example, refer to the first example of prepaid rent.

At the end of the accounting period, the cost of the supplies used during the period is computed and an adjusting entry is made to record the supplies expense. Prepare a journal entry to record this transaction.

To record prepaid expense. These are both asset accounts and do not increase or decrease a companys balance sheet. It is displayed as a current asset in the balance sheet as it is an advance payment. The journal entry is passed by making a debit entry in Account Receivable and corresponding credit entry in Sales Account. 15,000 cash for the rent of office space for the month. This entry is made as follows: Example. Once the journal entry for outstanding expenses has been posted they are then placed appropriately in the final accounts. and the software will update the accounts in the general ledger automatically.

The journal entry is passed by making a debit entry in Account Receivable and corresponding credit entry in Sales Account. The journal entry is given below. Prepaid Rent is the amount of rent paid by a firm in advance but the related benefits equivalent to the amount of advance payment are yet to be received. Prepaid expenses; Interest Expense Adjusting Entries. Examples of Deferred Revenue Journal Entry.

The benefits are due to be received in the future accounting period. 14. Prepaid Expenses. Under the asset method, a prepaid expense account (an asset) is recorded when the amount is paid. The past distinctions between bookkeeping and accounting have become blurred with the use of computers and accounting software. The payment relates to the salary due for the same month. You not only have to pay for the rent before every month, you also have to pay a security deposit. Lets assume that in March there were 30,000 due to be paid for rent which wasnt paid due to some reason.

Example. A debit entry in an account represents a transfer of value to that account, and a credit entry represents a transfer from the account. Hence, the journal entry above is simply increasing one asset (prepaid rent) together with the decreasing of another asset (cash). The rent repayment is calculated as follows. 14. Rent paid in advance Overview. Payment for the goods is made in the current accounting period, but the delivery is received in the upcoming accounting period. Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions. 1. March 10 Journal entry at the time of rent received Accrued Expenses Journal Entry. and the software will update the accounts in the general ledger automatically.